In 2012, the PBOC launched the construction of CIPS (phase 1).

In 2021, CIPS processed around 80 trillion yuan ($12.68 trillion), with about 1280 financial institutions in 103 countries and regions having connected to the system. CIPS also counts several foreign banks as shareholders including HSBC, Standard Chartered, the Bank of East Asia, DBS Bank, Citi, Australia and New Zealand Banking Group and BNP Paribas. Backed by the People's Bank of China (PBOC), China launched the CIPS in 2015 to internationalise RMB use. The Cross-Border Interbank Payment System ( CIPS) is a payment system which offers clearing and settlement services for its participants in cross-border RMB payments and trade. ( August 2022) ( Learn how and when to remove this template message) Please help improve it by removing promotional content and inappropriate external links, and by adding encyclopedic content written from a neutral point of view.

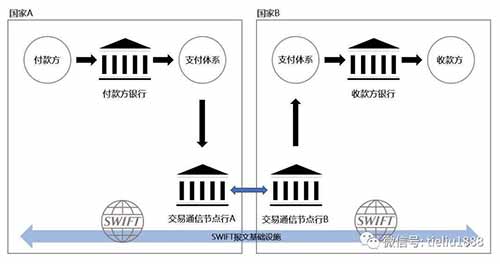

“Future plans could focus on the further extension of the operating window and settlement mechanism for liquidity efficiency, especially when the RMB will be included in the IMF’s reserve currency basket from October,” he says.This article contains content that is written like an advertisement. There is room for China to consider further extension of the CIPS operating window and alternative mechanisms – such as netted settlement – to enhance liquidity efficiency for CNY clearing, concludes Standard Chartered's Au. He suggests there is no need for the use of CIPS to become mandatory for all renminbi cross-border transactions, as the limitations of CNAPS in terms of operating hours and payment messages not adhering to international standards will ensure this happens without central-bank intervention. “It will also be connected with other financial markets and will consider overseas participants as direct participants.” “Phase-two objectives include a mixed settlement method which will save liquidity as well as improved RMB cross-border and offshore capital clearing and settlement efficiency,” says Thomson Reuters' Dalkali. The PBoC CIPS project team has not clearly indicated when the next phase of the system will go live, although participating banks anticipate it will happen next year. Speaking at a conference in July, PBoC deputy governor Chen Yulu said the central bank was planning a second phase of CIPS as part of plans to enhance international monetary and financial policy cooperation and coordination.Ī Renmin University of China/Bank of Communications report issued the same day suggested China should coordinate capital-account opening with exchange-rate reforms and comprehensive monitoring of capital flows.Ī number of banks have been invited to discussions around phase two, the scope of which will include the issue of connectivity with the onshore capital markets system. Underlying transactions are subject to the relevant national regulatory regime as well as banks’ infrastructure – for example, how the participating banks route their RMB payments: whether they use CNAPS, RMB-clearing banks or CIPS directly. In March, the number of indirect participants was increased to 253 and the institution that manages CIPS signed a memorandum of understanding with Swift, the global financial messaging service, setting out plans to connect CIPS with Swift’s global user community.ĬIPS executive director Li Wei has said his aim is to provide an inclusive platform to capture cross-border RMB flows to all types of participants.Ĭheung says neither the operating hours nor parameters of CIPS are a limiting factor, explaining: “If you compare the two systems, CNAPS only operated from 9am to 5pm whereas CIPS can process transactions between 9am to 8pm, which means it also covers part of the European working day.” At launch, CIPS had 19 directly participating banks – including nine foreign institutions – and another 176 banks indirectly involved. Participation in the system has grown relatively modestly. However, the PBoC denied it used CIPS to adjust offshore RMB liquidity. CIPS, launched in fairly low-key fashion by the People’s Bank of China (PBoC) last October, has not been without controversy.Įarlier this year, the China Association for the Promotion of Development Financing suggested in an article in the central bank’s newspaper that the system could be used to reduce the amount of renminbi funds available in the offshore market when short-selling arises.Ī large volume of yuan liquidity was released through CIPS to offshore markets after the launch of the system.

0 kommentar(er)

0 kommentar(er)